All Categories

Featured

[/video]

Withdrawals from the cash value of an IUL are commonly tax-free up to the quantity of premiums paid. Any kind of withdrawals above this quantity might be subject to taxes depending on policy structure.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for at the very least 5 years and the person is over 59. Properties taken out from a traditional or Roth 401(k) prior to age 59 may incur a 10% charge. Not specifically The claims that IULs can be your very own financial institution are an oversimplification and can be deceiving for many reasons.

You may be subject to updating associated health inquiries that can impact your ongoing expenses. With a 401(k), the cash is constantly yours, consisting of vested employer matching no matter whether you quit adding. Risk and Assurances: Primarily, IUL plans, and the cash value, are not FDIC guaranteed like standard checking account.

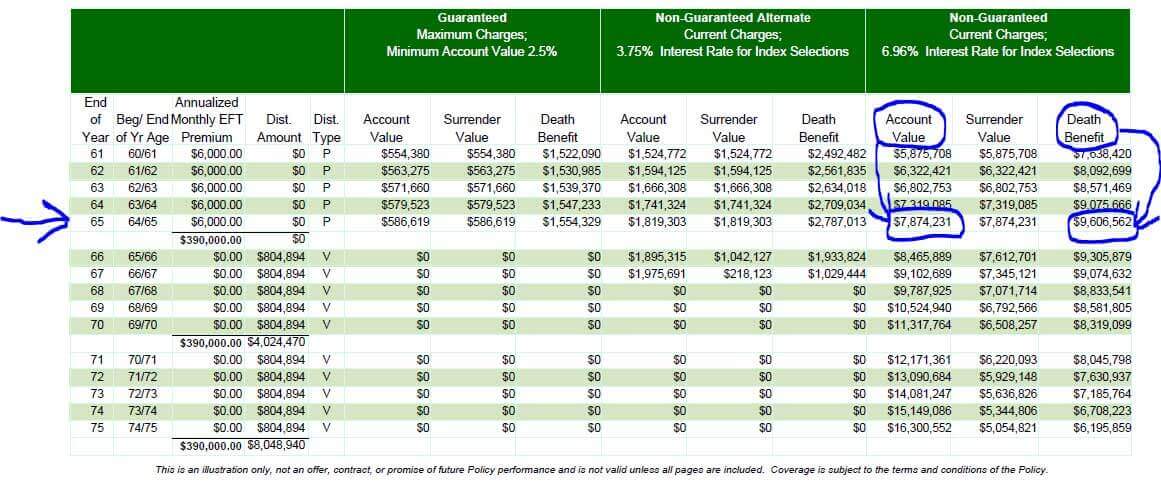

While there is normally a flooring to stop losses, the development potential is covered (suggesting you may not completely gain from market upswings). Many professionals will agree that these are not comparable products. If you want survivor benefit for your survivor and are worried your retirement financial savings will not be enough, then you may intend to consider an IUL or other life insurance coverage item.

Certain, the IUL can give access to a cash money account, yet once more this is not the primary purpose of the product. Whether you want or need an IUL is a very individual concern and depends on your key economic purpose and goals. Listed below we will try to cover advantages and constraints for an IUL and a 401(k), so you can further define these products and make an extra enlightened choice pertaining to the ideal method to take care of retirement and taking treatment of your enjoyed ones after death.

Is Indexed Universal Life A Good Investment

Lending Costs: Car loans against the policy accumulate passion and, otherwise settled, reduce the survivor benefit that is paid to the beneficiary. Market Involvement Restrictions: For a lot of policies, investment development is linked to a stock exchange index, however gains are generally covered, restricting upside prospective - using iul for retirement savings. Sales Practices: These policies are typically sold by insurance agents that may highlight benefits without fully discussing costs and threats

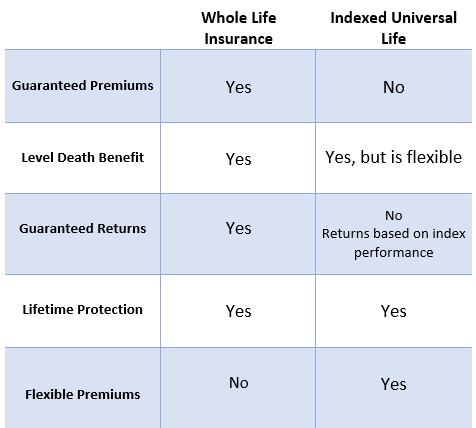

While some social media sites pundits suggest an IUL is an alternative item for a 401(k), it is not. These are various items with different purposes, functions, and prices. Indexed Universal Life (IUL) is a sort of long-term life insurance coverage policy that additionally supplies a cash money value component. The money value can be used for several purposes including retired life savings, supplementary income, and various other economic needs.

Latest Posts

Iul Annuity

L Iule Cross

Universal Index Life Insurance Policy